Unearthing Timeless Investment Wisdom: A Deep Dive into Warren Buffett's 1986 Letter

In the realm of investment literature, Warren Buffett's annual shareholder letters stand as hallowed ground. This post will dissect key takeaways from Buffett's 1986 letter, illustrating how his wisdom can be practically applied to modern investment decisions. We'll explore his emphasis on quality management, disciplined capital allocation, the perils of "cash flow" accounting, and the importance of maintaining a long-term perspective.

The Context: An Era of Shifting Markets

Before diving in, it's crucial to understand the context. The mid-1980s witnessed a period of economic recovery after the inflationary woes of the 1970s. Interest rates were declining, and the stock market was entering a strong bull run. However, shadows loomed: anxieties surrounding trade deficits, fluctuating oil prices, and evolving tax regulations created an environment ripe for both opportunity and risk. It's against this backdrop that Buffett shared his perspectives, acknowledging the changing dynamics while reaffirming his commitment to enduring principles.

1. The Indispensable Role of Exceptional Management

Buffett consistently emphasizes that people are paramount. This isn't merely a platitude; it's a cornerstone of his investment philosophy. He believes that outstanding managers can significantly enhance a business's intrinsic value, often in ways that aren't immediately reflected in financial statements.

"A large measure of our improvement in business value relative to book value reflects the outstanding performance of key managers at our major operating businesses... these managers… have over the years improved the earnings of their businesses dramatically while, except in the case of insurance, utilizing little additional capital. This accomplishment builds economic value, or 'Goodwill,' that does not show up in the net worth figure on our balance sheet..."

Explanation: Buffett values managers who possess integrity, competence, and a passion for their work. They operate with an owner's mindset, prioritizing long-term value creation over short-term gains. He seeks individuals who are already successful before joining Berkshire, allowing them autonomy and providing support without micromanagement.

Modern Application: In today's world, analyzing management teams requires a thorough understanding of their track record, leadership style, and alignment with shareholder interests.

Example: Consider Satya Nadella's transformation of Microsoft. Upon taking the helm, he shifted the company's focus to cloud computing, embraced open-source technologies, and fostered a collaborative work environment. This strategic shift, driven by Nadella's leadership, revitalized Microsoft and created significant value for shareholders.

2. The Art of Capital Allocation: A Core Competency

Buffett views capital allocation as one of his most critical responsibilities. Effectively deploying retained earnings is paramount for businesses aiming to compound wealth over time.

"The second job Charlie and I must handle is the allocation of capital, which at Berkshire is a considerably more important challenge than at most companies... If our retained earnings - and those of our major investees... are employed in an unproductive manner, the economics of Berkshire will deteriorate very quickly."

Explanation: Buffett understands that not all investment opportunities are created equal. He seeks businesses that require minimal incremental capital to grow, allowing for reinvestment in high-return ventures or the acquisition of new, promising businesses. He prioritizes disciplined capital allocation, opting to stockpile cash rather than invest in subpar opportunities.

Modern Application: Investors must evaluate how effectively companies deploy their capital. Key metrics include return on invested capital (ROIC) and free cash flow generation. A high ROIC indicates that a company is generating substantial profits from its investments, while strong free cash flow provides flexibility for reinvestment, acquisitions, or shareholder returns.

Note: Here is one way of calculating Return on Invested Capital (ROIC) from Amazon Income and Balance sheet:

ROIC = NOPAT (Net Operating Profit After Taxes) / Invested Capital × 100%

Where:

- NOPAT (Net Operating Profit After Taxes) = Operating Income × (1 - Tax Rate)

- Invested Capital = Total Assets - Current Liabilities - Cash and Cash Equivalents

Let's calculate this using Amazon's financial statements:

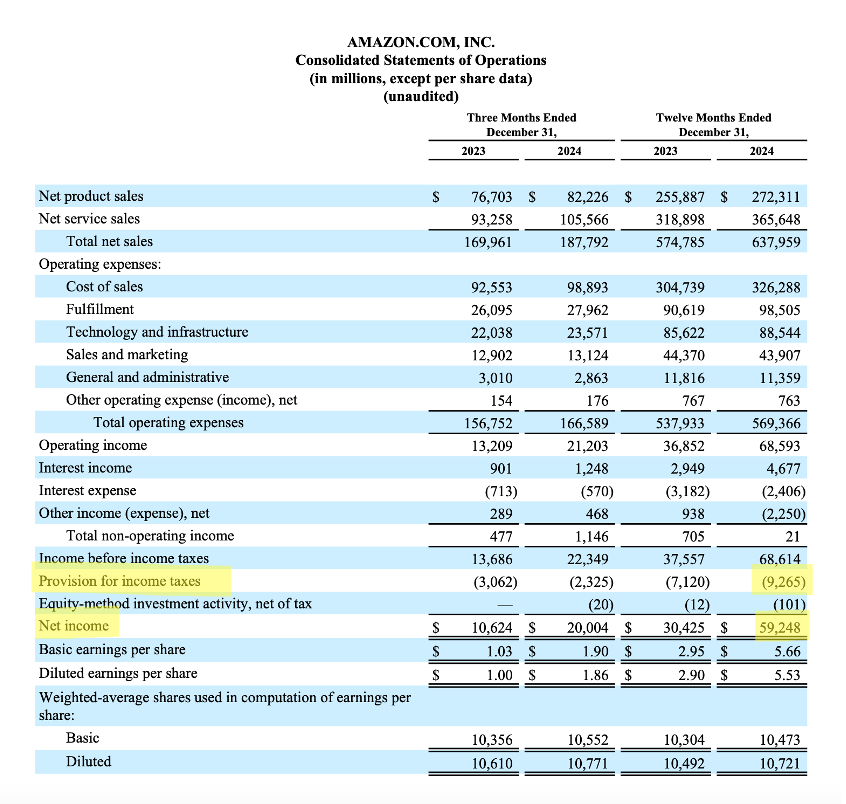

Step 1: Calculate NOPAT From Income Statement (2024):

- Operating Income: $68,593M

- Tax Rate (Effective): $9,265M ÷ $68,614M = 13.5%

NOPAT = $68,593M × (1 - 0.135) = $59,333M

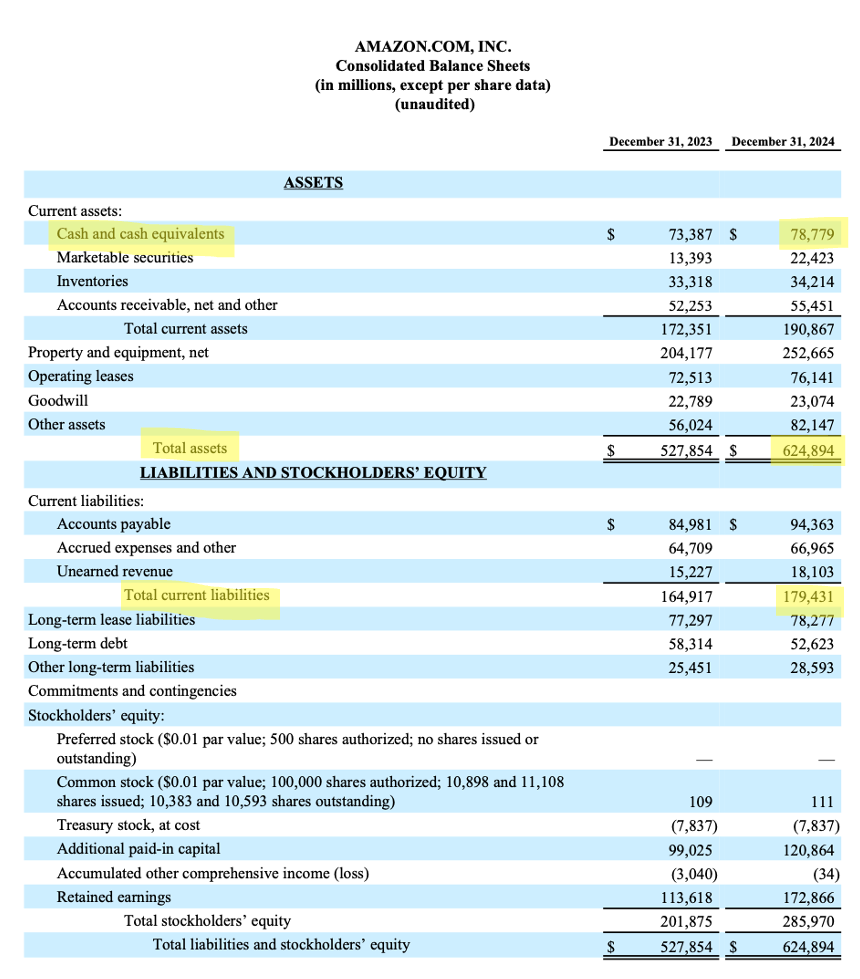

Step 2: Calculate Invested Capital From Balance Sheet (2024):

- Total Assets: $624,894M

- Current Liabilities: $179,431M

- Cash and Cash Equivalents: $78,779M

Invested Capital = $624,894M - $179,431M - $78,779M = $366,684M

Step 3: Calculate ROIC ROIC = $59,333M ÷ $366,684M × 100% = 16.2%

What This Means:

- Amazon generates about $16.20 in operating profit for every $100 of capital invested

- This is considered a strong ROIC, indicating efficient use of capital

3. The Perils of "Cash Flow" Accounting: A Cautionary Tale

In the appendix to the letter, Buffett tackles the deceptive nature of "cash flow" metrics that are often used in place of GAAP earnings. He emphasizes the importance of considering capital expenditures required to maintain a business's competitive position when evaluating a company's true earnings power.

"All of this points up the absurdity of the 'cash flow' numbers that are often set forth in Wall Street reports... These imply that the business being offered is the commercial counterpart of the Pyramids - forever state-of-the-art, never needing to be replaced, improved or refurbished... But you shouldn't add (b) without subtracting ( c): though dentists correctly claim that if you ignore your teeth they'll go away, the same is not true for ( c)."

Explanation: Buffett argues that simply adding back depreciation to net income to arrive at "cash flow" provides a misleading picture of a company's financial health. He introduces the concept of "owner earnings," which adjusts reported earnings for the capital expenditures necessary to maintain a company's long-term competitive advantage.

Buffett's Owner Earnings Formula:

Owner Earnings = Net Income + Depreciation - Capital Expenditures Needed to Maintain Competitive Position

From Amazon's Statements:

A. Net Income (2024): $59,248M

B. Add Back:

- Depreciation and Amortization: $52,795M

- Stock-based Compensation: $22,011M (These are non-cash charges)

C. Subtract Capital Expenditures:

- Total CapEx: $82,999M (Shown as "Purchases of property and equipment" in Cash Flow Statement)

Basic Calculation: $59,248M + $52,795M - $82,999M = $29,044M

However, let's go deeper into what this means:

Competitive Position Analysis:

- Core Infrastructure Investment

- Amazon's heavy CapEx ($82,999M) reflects investments in:

- Fulfillment centers

- AWS data centers

- Logistics network

- Technology infrastructure

- Maintenance vs Growth CapEx

- Not all of Amazon's CapEx is maintenance

- Significant portion is for growth and expanding capabilities

- Estimated maintenance CapEx might be 40-50% of total

True Owner Earnings Calculation If we assume 45% of CapEx is maintenance: Maintenance CapEx = $82,999M × 0.45 = $37,350M

Revised Owner Earnings: $59,248M + $52,795M - $37,350M = $74,693M

This shows assumption 45% of CapEX goes to maintenance Amazon generates True Cash Generation Power

- It shows Amazon generates about $74.7B in real cash earnings

- This is significantly higher than reported net income of $59.2B

- Think of it as the "real money" Amazon makes after maintaining its existing business

But if we assume 90% of CapEX goes to maintenance then amazon as investment opportunity changes because

- Much lower true cash generation as shown below.

- Suggests business requires heavy reinvestment

- Less attractive return on capital

- Limited funds available for growth

True Owner Earnings Calculation If we assume 90% of CapEx is maintenance: Maintenance CapEx = $82,999M × 0.95= $78.849M

Revised owner Earnings = $59,248M + $52,795M - $78,849M = $33,194M

This example shows why Buffett is focusing on revised owner earnings.

4. Patience and Discipline: Waiting for the Right Pitch

Buffett's 1986 letter acknowledges the difficulty in finding attractive investment opportunities in the prevailing market conditions. He emphasizes the importance of patience and discipline, opting to stockpile cash rather than chase overvalued assets.

"Meanwhile, we had no new ideas in the marketable equities field, an area in which once, only a few years ago, we could readily employ large sums in outstanding businesses at very reasonable prices. So our main capital allocation moves in 1986 were to pay off debt and stockpile funds. Neither is a fate worse than death, but they do not inspire us to do handsprings either."

Explanation: Buffett advocates for a long-term perspective, resisting the temptation to invest simply for the sake of being active. He waits for opportunities where he can purchase high-quality businesses at prices below their intrinsic value.

Modern Application: In today's fast-paced market, where FOMO (Fear Of Missing Out) often drives investment decisions, it's essential to maintain a disciplined approach. Resist the urge to chase hot stocks or trendy sectors without a thorough understanding of their fundamentals. Patiently wait for opportunities where you can buy undervalued assets with strong long-term potential.

Practical Takeaways for Today's Investor

- Prioritize Quality Management: Seek out companies with experienced, ethical, and shareholder-aligned management teams.

- Analyze Capital Allocation: Evaluate how effectively companies deploy their capital, focusing on ROIC and free cash flow generation.

- Scrutinize "Cash Flow" Metrics: Understand the limitations of non-GAAP metrics and focus on "owner earnings" after accounting for necessary capital expenditures.

- Embrace Patience and Discipline: Resist the urge to chase overvalued assets and wait for opportunities to buy high-quality businesses at reasonable prices.

- Adopt a Long-Term Perspective: Focus on long-term value creation rather than short-term gains, and avoid being swayed by market hype.