Decoding Buffett's Wisdom: Investment Lessons from the 1981 Letter

In 1981, amidst economic uncertainty and high inflation, Warren Buffett crafted a shareholder letter that stands as a testament to timeless investment principles. Let's delve into some of the key takeaways from Buffett's 1981 letter and explore their enduring applicability for investors of all levels.

Understanding "Non-Controlled Ownership Earnings"

Buffett introduces the concept of "non-controlled ownership earnings," which is Berkshire's share of the undistributed earnings from companies in which they hold significant investments but don't control. He writes:

"However, our belief is that, in aggregate, those undistributed and, therefore, unrecorded earnings will be translated into tangible value for Berkshire shareholders just as surely as if subsidiaries we control had earned, retained - and reported - similar earnings."

Explanation: This highlights the importance of considering a company's total earnings, not just the portion paid out as dividends. Retained earnings, when reinvested wisely, can fuel future growth and ultimately drive shareholder value.

Real-World Application: Many tech companies today, like Amazon or Alphabet (Google), historically retained a large portion of their earnings to invest in new ventures and expansion. This strategy, while initially foregoing immediate dividends, has yielded substantial long-term returns for shareholders. Investors need to look beyond current dividends and assess how management utilizes retained earnings to create future value.

Modern Context: This concept is even more critical today with the rise of growth stocks that prioritize reinvestment over dividends. It's a reminder to assess the quality of management and their ability to deploy capital effectively. Are they building a long-term moat, or simply throwing money at fleeting trends?

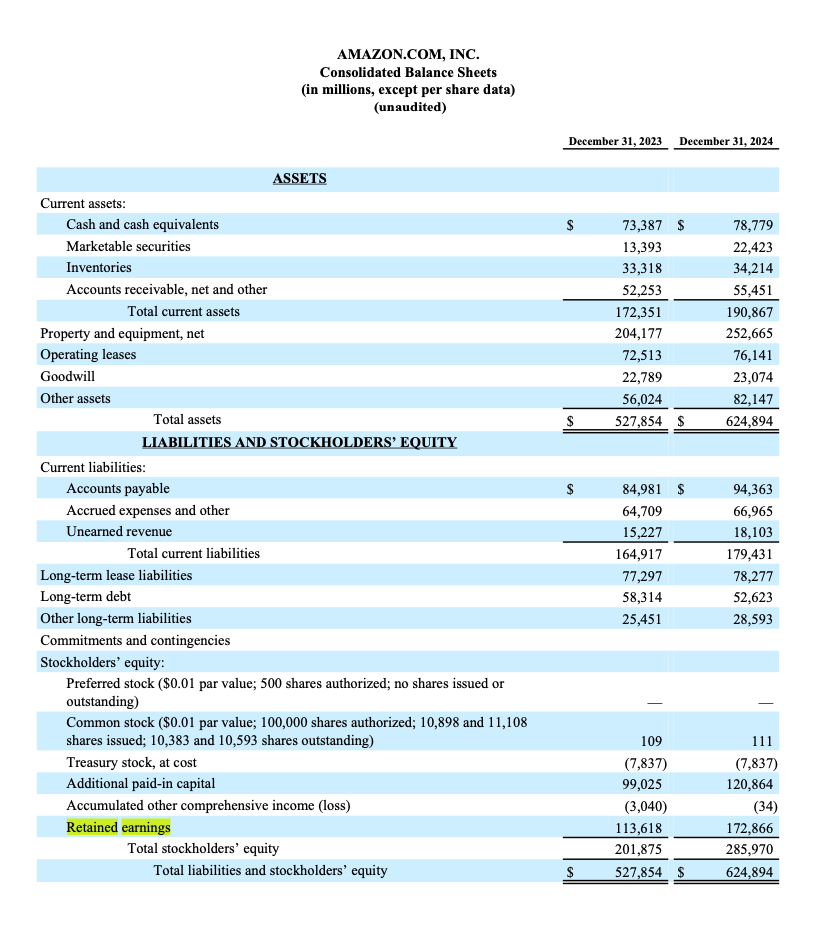

Retained earnings can be found in balance sheet document of a company's earnings release and as you can see in highlighted yellow it represents all the profits Amazon has chosen to keep and reinvest in the business rather than distribute to shareholders as dividends. Amazon retained earnings of $172,866 million (or roughly $172.9 billion) as of December 31, 2024, up significantly from $113,618 million in the previous year.

Benefits of High Retained Earnings:

- Growth Investment Capability Having significant retained earnings gives Amazon tremendous financial flexibility to invest in new ventures, technologies, and market expansion without relying heavily on external financing. This self-funding capability has enabled Amazon to rapidly enter new markets and develop innovative services like AWS, Prime, and their logistics network.

- Financial Stability The large retained earnings balance serves as a financial cushion, helping Amazon weather economic downturns or unexpected challenges. This stability was particularly valuable during periods of market uncertainty.

- Strategic Independence By maintaining high retained earnings, Amazon can make long-term strategic decisions without being overly concerned about short-term market reactions or the need to satisfy immediate shareholder dividend expectations.

- Competitive Advantage The ability to reinvest substantial profits has allowed Amazon to build competitive moats through infrastructure development, technology advancement, and market presence that smaller competitors find difficult to match.

Avoiding "Toad Kissing" in Acquisitions

Buffett's wit shines through in his discussion of corporate acquisitions, particularly his aversion to overpaying. He famously states:

"Regardless of the impact upon immediately reportable earnings, we would rather buy 10% of Wonderful Business T at X per share than 100% of T at 2X per share. Most corporate managers prefer just the reverse, and have no shortage of stated rationales for their behavior."

He then elaborates on the potential motivations behind overpaying, including "animal spirits," the desire for size, and the belief that managerial skill can magically transform struggling companies. He encapsulates this with the analogy of paying double the price to kiss a toad in the hopes it will turn into a prince.

Explanation: Buffett is criticizing the tendency of managers to prioritize empire-building over shareholder value. Overpaying for acquisitions often leads to lower returns on invested capital and can ultimately harm the acquirer's stock price.

Equity Value-Added and the Impact of Interest Rates

Buffett dedicates a significant portion of the letter to discussing "Equity Value-Added," a concept particularly relevant in the high-interest rate environment of the early 1980s. He argues that when passive investment returns (like bond yields) are high, companies need to generate even higher returns on equity to justify their valuations. He elaborates:

"Unless passive rates fall, companies achieving 14% per year gains in earnings per share while paying no cash dividend are an economic failure for their individual shareholders. The returns from passive capital outstrip the returns from active capital. This is an unpleasant fact for both investors and corporate managers and, therefore, one they may wish to ignore. But facts do not cease to exist, either because they are unpleasant or because they are ignored."

Explanation: Buffett highlights a crucial but often overlooked point: the opportunity cost of investing in equities. If investors can earn a substantial return from low-risk investments like bonds, companies must generate even greater returns to compensate for the higher risk of equity ownership.

Real-World Application: With interest rates rising in recent years after a decade of near-zero rates, this principle is more pertinent than ever. Companies that once looked attractive with low borrowing costs now face tougher scrutiny as investors demand higher returns to justify their investment.

Modern Context: This analysis serves as a powerful reminder that valuation is relative. A company's intrinsic value is not fixed but is influenced by the prevailing interest rate environment and the availability of alternative investment options. Investors should adjust their expectations and valuation models accordingly.

The Tapeworm of Inflation

Buffett understood the devastating impact of inflation on businesses, particularly those with low returns on equity. He famously described inflation as:

"For inflation acts as a gigantic corporate tapeworm. That tapeworm preemptively consumes its requisite daily diet of investment dollars regardless of the health of the host organism. Whatever the level of reported profits (even if nil), more dollars for receivables, inventory and fixed assets are continuously required by the business in order to merely match the unit volume of the previous year. The less prosperous the enterprise, the greater the proportion of available sustenance claimed by the tapeworm."

Explanation: Inflation erodes purchasing power and forces companies to reinvest increasing amounts of capital just to maintain their existing operations. This leaves less capital available for growth, dividends, or debt reduction.

Practical Takeaways for Investors

So, how can we apply these lessons from Buffett's 1981 letter to our own investment strategies? Here are a few key takeaways:

- Focus on Total Earnings: Don't solely rely on dividend yields. Analyze how management reinvests retained earnings to drive long-term growth.

- Be Wary of Acquisitions: Scrutinize corporate acquisitions and ensure the price is justified by the potential benefits. Avoid companies that overpay for deals.

- Consider Opportunity Cost: Understand the impact of interest rates on valuations. Demand higher returns from equities when passive investments offer attractive yields.

- Seek Pricing Power: Favor businesses that can pass on inflationary pressures to customers without losing market share.

- Embrace Patience: Value investing requires patience and discipline. Don't be swayed by market hype or short-term trends.

Connecting Past Wisdom to Present Opportunities

Warren Buffett's 1981 letter is more than just a historical document; it's a timeless guide to sound investing. By understanding the principles he espoused, we can better navigate the complexities of the modern market and make informed investment decisions. While the economic landscape may have changed, the fundamental principles of value investing, risk management, and rational decision-making remain as relevant today as they were over four decades ago. By learning from the past, we can position ourselves for success in the future. The key is to remember that investing is not about chasing the latest fad but about understanding the underlying economics of a business and paying a fair price for its future earnings. That's a lesson that will never go out of style.