Decoding Buffett's 1977 Letter: Timeless Wisdom for the Modern Investor

The Oracle of Omaha. Warren Buffett. His name is synonymous with successful, long-term investing. While many seek complex formulas and cutting-edge algorithms, Buffett's philosophy, outlined consistently in his annual letters, remains remarkably simple, yet profoundly effective. Let's explore how Buffett's wisdom from 1977 can help us navigate the modern investment landscape.

1. The Primacy of Return on Equity: Beyond Earnings Per Share

Buffett wastes no time in the 1977 letter in challenging conventional wisdom, in this case a company reporting “record earnings”. He states:

"Most companies define “record” earnings as a new high in earnings per share. Since businesses customarily add from year to year to their equity base, we find nothing particularly noteworthy in a management performance combining, say, a 10% increase in equity capital and a 5% increase in earnings per share. After all, even a totally dormant savings account will produce steadily rising interest earnings each year because of compounding."

He continues by adding:

"Except for special cases… we believe a more appropriate measure of managerial economic performance to be return on equity capital. In 1977 our operating earnings on beginning equity capital amounted to 19%, slightly better than last year and above both our own long-term average and that of American industry in aggregate."

Explanation: Buffett emphasizes return on equity (ROE) as a superior metric for evaluating management performance compared to the often-touted earnings per share (EPS). ROE measures how efficiently a company is using shareholder investments to generate profits. A high ROE indicates that a company is generating significant profit from each dollar of equity. Simply looking at EPS can be misleading because it doesn't account for the amount of capital invested to achieve those earnings.

Real-World Application: Let's imagine two retail companies, RetailMaster and ShopSmart, both appearing successful at first glance. We'll analyze their performance over a year to understand why Buffett emphasizes ROE over EPS.

RetailMaster's Performance:

- Initial Shareholders' Equity: $1,000,000

- Net Income: $150,000

- Equity at Year End: $1,500,000 (after raising additional capital)

- Earnings Per Share: Increased from $1.00 to $1.10 (10% growth)

- ROE = $150,000 ÷ $1,000,000 = 15%

ShopSmart's Performance:

- Initial Shareholders' Equity: $1,000,000

- Net Income: $200,000

- Equity at Year End: $1,050,000 (mostly retained earnings)

- Earnings Per Share: Increased from $1.00 to $1.05 (5% growth)

- ROE = $200,000 ÷ $1,000,000 = 20%

The Deeper Analysis:

RetailMaster might appear more attractive at first glance because it shows higher EPS growth (10% vs 5%). However, looking deeper reveals a different story. RetailMaster achieved this growth by raising additional capital from shareholders, essentially using more resources to generate its returns.

ShopSmart, despite showing lower EPS growth, actually demonstrates superior management performance with a 20% ROE compared to RetailMaster's 15%. This means ShopSmart generates more profit for each dollar of shareholder investment.

Think of it like two restaurant owners:

- RetailMaster's approach is like a restaurant owner who buys a second location to increase total profits. Yes, they're making more money in absolute terms, but they needed significant additional investment to do so.

- ShopSmart's approach is like a restaurant owner who increases profits by improving efficiency, menu optimization, and customer service at their existing location. They're generating more profit from their original investment.

This example illustrates Buffett's point perfectly. While EPS growth can be achieved by simply throwing more money at the business, ROE reveals how efficiently management is using shareholder capital to generate returns. A company generating a higher ROE is often creating more value for shareholders because it's achieving better results with the same or less capital.

Today, investors are bombarded with EPS figures in news headlines and company reports. Buffett's guidance encourages us to dig deeper and assess the underlying profitability and efficiency of a business by considering its ROE.

Return on Beginning Equity Capital Formula:

Net Income / Beginning Shareholders' Equity × 100%

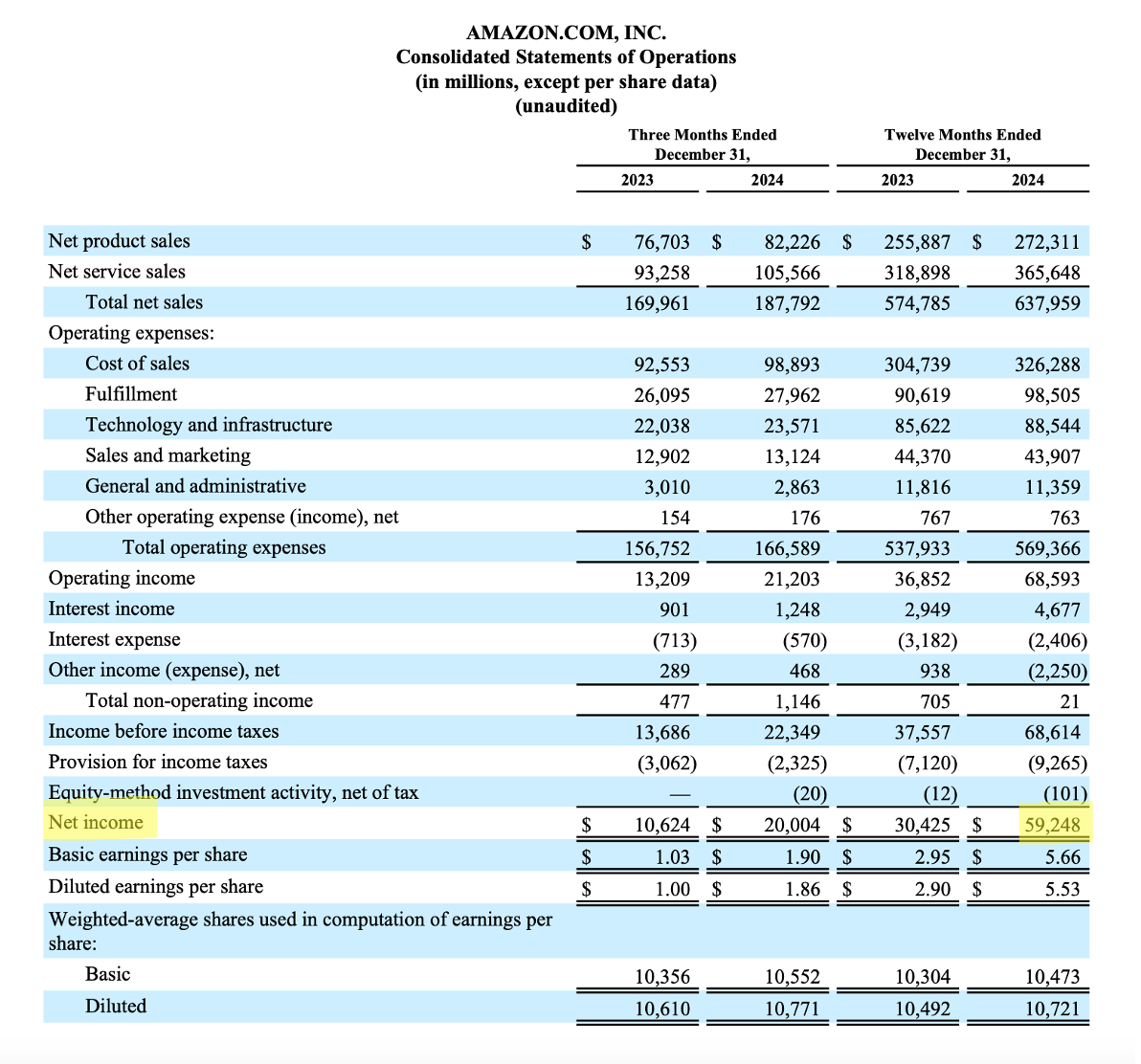

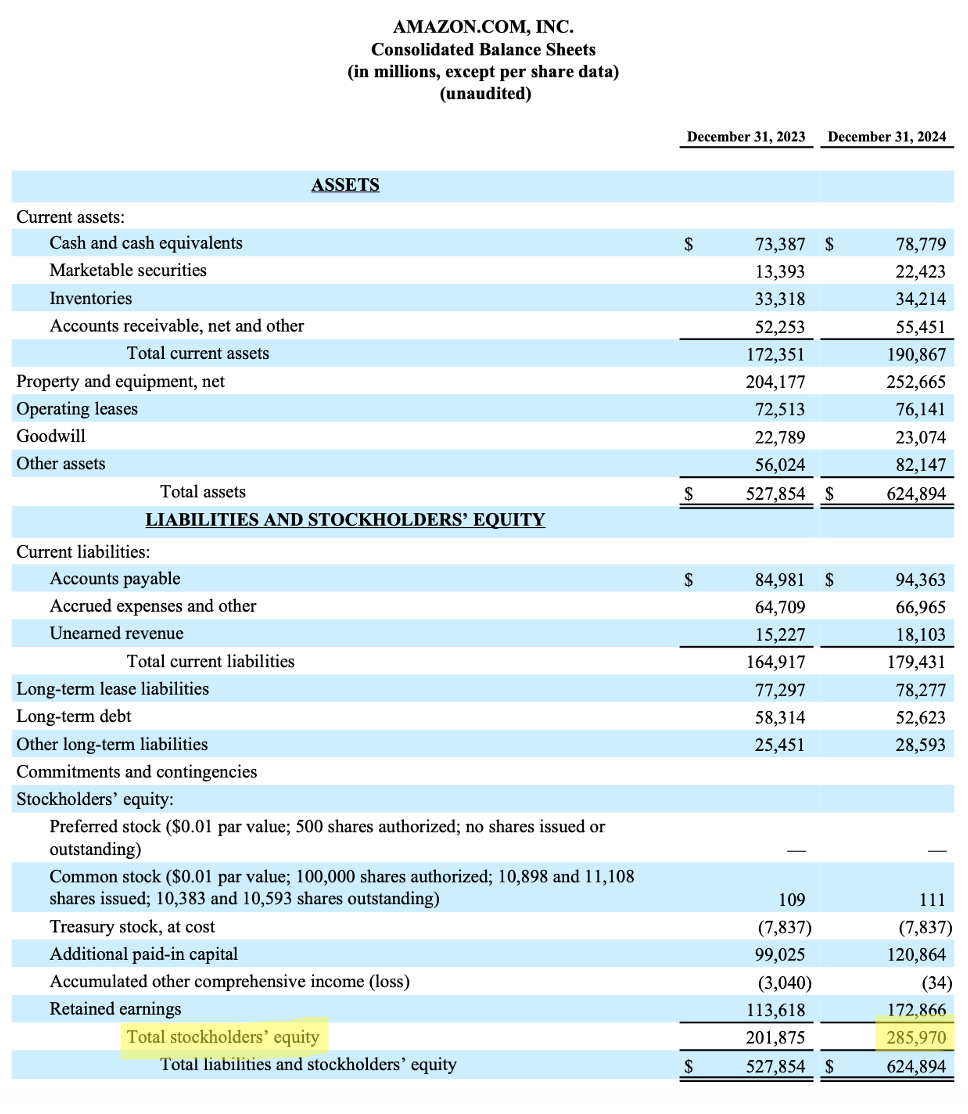

Net Income:

- Found on the Income Statement (also called Profit & Loss Statement)

- It's typically the bottom line, labeled as "Net Income" or "Net Earnings"

Beginning Shareholders' Equity:

- Found on the Balance Sheet

- For 2025's beginning equity, you'll use the December 31, 2024 balance sheet number

- Look for "Total Stockholders' Equity" or "Total Shareholders' Equity"

In the above Amazon Example Return on Beginning Equity Capital = 59,248 Million % 285,970 Million = 20.17% . In simple terms it means that for every $100 of shareholders' equity at the start of the period, Amazon generated $20.17 in net income.

Modern Context: The focus on ROE is even more relevant in today's era of low interest rates. With returns on traditional fixed-income investments suppressed, investors need to identify companies that can generate superior returns on equity to achieve their financial goals. Companies with consistently high ROEs often possess strong competitive advantages, effective management, and disciplined capital allocation strategies.

2. Understanding the Business: The Circle of Competence

Buffett dedicates a portion of the letter to discussing Berkshire's textile operations, which were struggling significantly. He writes:

"A few shareholders have questioned the wisdom of remaining in the textile business which, over the longer term, is unlikely to produce returns on capital comparable to those available in many other businesses. Our reasons are several... (3) With hard work and some imagination regarding manufacturing and marketing configurations, it seems reasonable that at least modest profits in the textile division can be achieved in the future."

While Buffett's initial reasons involved employee welfare and loyalty, the core message is about understanding the business. He also indirectly references this when highlighting the success of National Indemnity when he states:

“One of the lessons your management has learned - and, unfortunately, sometimes re-learned - is the importance of being in businesses where tailwinds prevail rather than headwinds.”

Explanation: Buffett is a strong proponent of investing within one's "circle of competence." This means focusing on businesses you understand intimately – their economics, competitive landscape, and potential for growth. He admits to past forecasting errors in the textile business, illustrating the importance of acknowledging one's limitations. Investing outside your circle of competence increases the risk of making poor decisions based on incomplete or inaccurate information.

Real-World Application: Consider an investor with deep expertise in software development. They understand the dynamics of the software industry, the competitive pressures, and the key technological trends. This investor would be better positioned to evaluate the prospects of a software company than, say, a pharmaceutical company, where they lack specialized knowledge.

Many investors fall into the trap of chasing "hot" stocks or sectors they don't understand, lured by the promise of quick profits. Buffett's approach emphasizes sticking to what you know, even if it means missing out on some perceived opportunities.

Modern Context: In today's world of rapidly evolving technologies and complex business models, defining one's circle of competence is more crucial than ever. The rise of AI, blockchain, and other disruptive forces demands that investors possess a strong understanding of the underlying technologies and their potential impact on various industries. It's tempting to jump on the bandwagon of the latest tech craze, but Buffett's wisdom reminds us to only invest in businesses we truly understand.

3. The Power of "Float" in Insurance

Buffett emphasizes the importance of insurance in the company's underwriting.

"In 1977 the winds in insurance underwriting were squarely behind us. Very large rate increases were effected throughout the industry in 1976 to offset the disastrous underwriting results of 1974 and 1975. But, because insurance policies typically are written for one-year periods, with pricing mistakes capable of correction only upon renewal, it was 1977 before the full impact was felt upon earnings of those earlier rate increases."

He also states:

"Insurance companies offer standardized policies which can be copied by anyone. Their only products are promises. It is not difficult to be licensed, and rates are an open book. There are no important advantages from trademarks, patents, location, corporate longevity, raw material sources, etc., and very little consumer differentiation to produce insulation from competition. It is commonplace, in corporate annual reports, to stress the difference that people make. Sometimes this is true and sometimes it isn’t. But there is no question that the nature of the insurance business magnifies the effect which individual managers have on company performance. We are very fortunate to have the group of managers that are associated with us."

Explanation: Buffett highlights the significant growth in Berkshire Hathaway's insurance operations and the importance of "float." Float is the money insurance companies hold between collecting premiums and paying out claims. If the insurance company is well-managed and its underwriting is profitable, the float becomes a source of interest-free capital that can be invested to generate further returns. A combination of good management, policies, and the amount of 'float' are all keys to a successful insurance business.

Real-World Application: Berkshire Hathaway has famously used its insurance float to invest in a diverse portfolio of businesses, ranging from railroads to energy companies. This access to cheap capital has been a major driver of Berkshire's long-term success.

While individual investors don't have access to insurance float, the concept highlights the importance of understanding a company's funding structure and how it uses capital. Companies with access to low-cost capital have a significant advantage over competitors who rely on expensive debt or equity financing.

Modern Context: In an era of readily available credit, understanding a company's financial structure and its ability to generate free cash flow is paramount. Companies that can generate significant free cash flow, similar to the way insurance companies generate float, are better positioned to invest in growth opportunities, pay dividends, and repurchase shares, ultimately creating value for shareholders.

Note: Free Cash flow can be calculated using

Free Cash Flow = Operating Cash Flow - Capital Expenditures

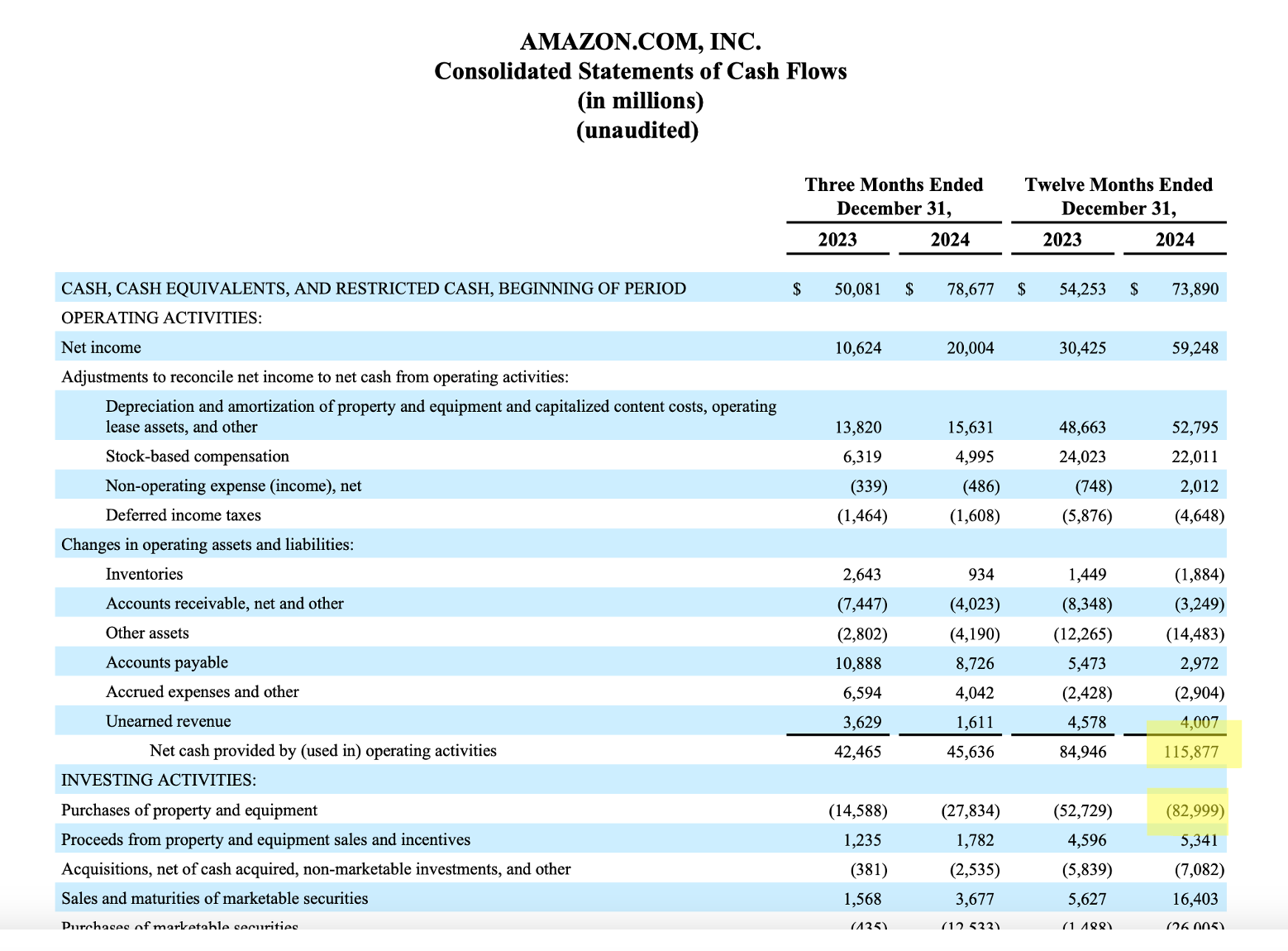

Let's look at the twelve months ended December 31, 2024 in below cash flow statement image:

- Operating Cash Flow (as highlighted in yellow): $115,877 million This is shown as "Net cash provided by operating activities" and represents the cash Amazon generated from its core business operations.

- Capital Expenditures (as highlighted in yellow): $82,999 million This appears as "Purchases of property and equipment" under investing activities. This represents Amazon's investments in physical assets like warehouses, data centers, and equipment.

Therefore, Amazon's Free Cash Flow for 2024 = $115,877M - $82,999M = $32,878 million

To put this in perspective, let's compare it to 2023: 2023 Operating Cash Flow: $84,946M 2023 Capital Expenditures: $52,729M 2023 Free Cash Flow = $84,946M - $52,729M = $32,217 million

What this tells us:

- Operating cash flow increased significantly (36.4%) from $84,946M to $115,877M, showing strong business performance.

- Capital expenditures also increased substantially (57.4%) from $52,729M to $82,999M, indicating Amazon is heavily investing in future growth.

- Despite much higher capital spending, Amazon maintained steady free cash flow (slight increase from $32,217M to $32,878M).

Think of it like a successful restaurant chain:

- Operating cash flow is like the money the restaurants bring in from selling food

- Capital expenditures are like building new locations and upgrading kitchen equipment

- Free cash flow is what's left after paying for all the expansion and upgrades

The significant capital expenditure suggests Amazon is positioning itself for future growth, while still maintaining healthy free cash flow that can be used for other purposes like debt reduction, acquisitions, or shareholder returns.

4. Long-Term Investing and the Bargain Hunter Approach

Buffett makes his approach to investing clear in the letter:

"We select our marketable equity securities in much the same way we would evaluate a business for acquisition in its entirety. We want the business to be (1) one that we can understand, (2) with favorable long-term prospects, (3) operated by honest and competent people, and (4) available at a very attractive price. We ordinarily make no attempt to buy equities for anticipated favorable stock price behavior in the short term. In fact, if their business experience continues to satisfy us, we welcome lower market prices of stocks we own as an opportunity to acquire even more of a good thing at a better price."

Explanation: Buffett emphasizes a value-oriented, long-term approach to investing. He seeks businesses with strong fundamentals, trustworthy management, and attractive valuations. He explicitly avoids short-term speculation and embraces market downturns as opportunities to buy more of his favorite companies at discounted prices.

Real-World Application: During market corrections, many investors panic and sell their holdings, locking in losses. Buffett's approach encourages us to do the opposite – to remain calm, assess the long-term prospects of our investments, and potentially add to our positions if the underlying businesses remain sound.

Modern Context: In the age of high-frequency trading and instant news, it's easy to get caught up in the short-term noise of the market. Buffett's wisdom reminds us to focus on the long-term fundamentals of the businesses we own and to avoid making impulsive decisions based on fleeting market sentiment. This approach has only gotten easier with the development of low-cost brokerages and the availability of financial research reports.

Practical Takeaways for Today's Investor

Based on Buffett's 1977 letter, here are some practical steps you can take to improve your investing strategy:

- Focus on ROE: Don't be swayed by EPS alone. Analyze a company's ROE to understand how effectively it's using shareholder capital.

- Stay Within Your Circle: Invest in businesses you understand. Avoid chasing trends or sectors you lack expertise in.

- Understand Capital Structure: Analyze a company's funding and its ability to generate free cash flow.

- Embrace Long-Term Thinking: Avoid short-term speculation. Focus on the long-term fundamentals of the businesses you own.

- Be a Value Hunter: Seek out undervalued companies with strong management and favorable long-term prospects.

Connecting Past Wisdom to Present Opportunities

Warren Buffett's 1977 letter offers a refreshing dose of common sense in a world often obsessed with complexity. While the financial markets and technological landscape have changed dramatically since 1977, the core principles of sound investing – understanding the business, focusing on long-term value, and remaining disciplined – remain as relevant as ever. By applying these timeless lessons, today's investors can navigate the market with greater confidence and build long-term wealth.