Buffett's 1980 Playbook: How His Inflation-Era Wisdom Can Protect Your Portfolio Today

In 1980, the world was grappling with stagflation, high-interest rates, and geopolitical uncertainty. Against this backdrop, Warren Buffett penned his annual shareholder letter, delivering a dose of reality tempered with enduring wisdom. While the specifics of the era might seem distant, the underlying principles articulated in this letter remain remarkably relevant for today's investors navigating a similarly complex and volatile landscape.

This isn't just a historical artifact; it's a foundational text for value investors. Let's unpack key insights from Buffett's 1980 letter and see how they can be applied to your investment strategy.

1. The Illusion of Earnings Per Share (EPS) Growth: Focus on Return on Equity

Buffett wastes no time in challenging conventional wisdom, directly addressing the overemphasis on Earnings Per Share (EPS). He argues that focusing solely on EPS can be misleading and mask underlying business performance.

"The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.) and not the achievement of consistent gains in earnings per share."

Explanation: Buffett emphasizes Return on Equity (ROE) as a superior metric. ROE measures how efficiently a company uses shareholder equity to generate profits. A high ROE indicates that a company is effectively deploying capital to create value. EPS, on the other hand, can be artificially inflated through share buybacks or obscured by accounting manipulations.

Real-World Application: Consider two companies, both with 10% EPS growth. Company A achieves this through genuine operational improvements and reinvesting profits, resulting in a stable 15% ROE. Company B achieves the same EPS growth through aggressive share buybacks, masking a declining ROE of 8%. A superficial EPS analysis would suggest equal performance, while a deeper dive into ROE reveals that Company A is the far superior investment.

Modern Context: In today's market, where companies are often judged on short-term metrics and quarterly earnings reports, Buffett's emphasis on ROE serves as a critical reminder to look beyond the surface and evaluate the fundamental profitability and efficiency of a business. Investors should prioritize companies that consistently generate high ROE, demonstrating their ability to compound capital effectively.

To calculate Return on Beginning Equity Capital Formula use the formulae:

Net Income / Beginning Shareholders' Equity × 100%

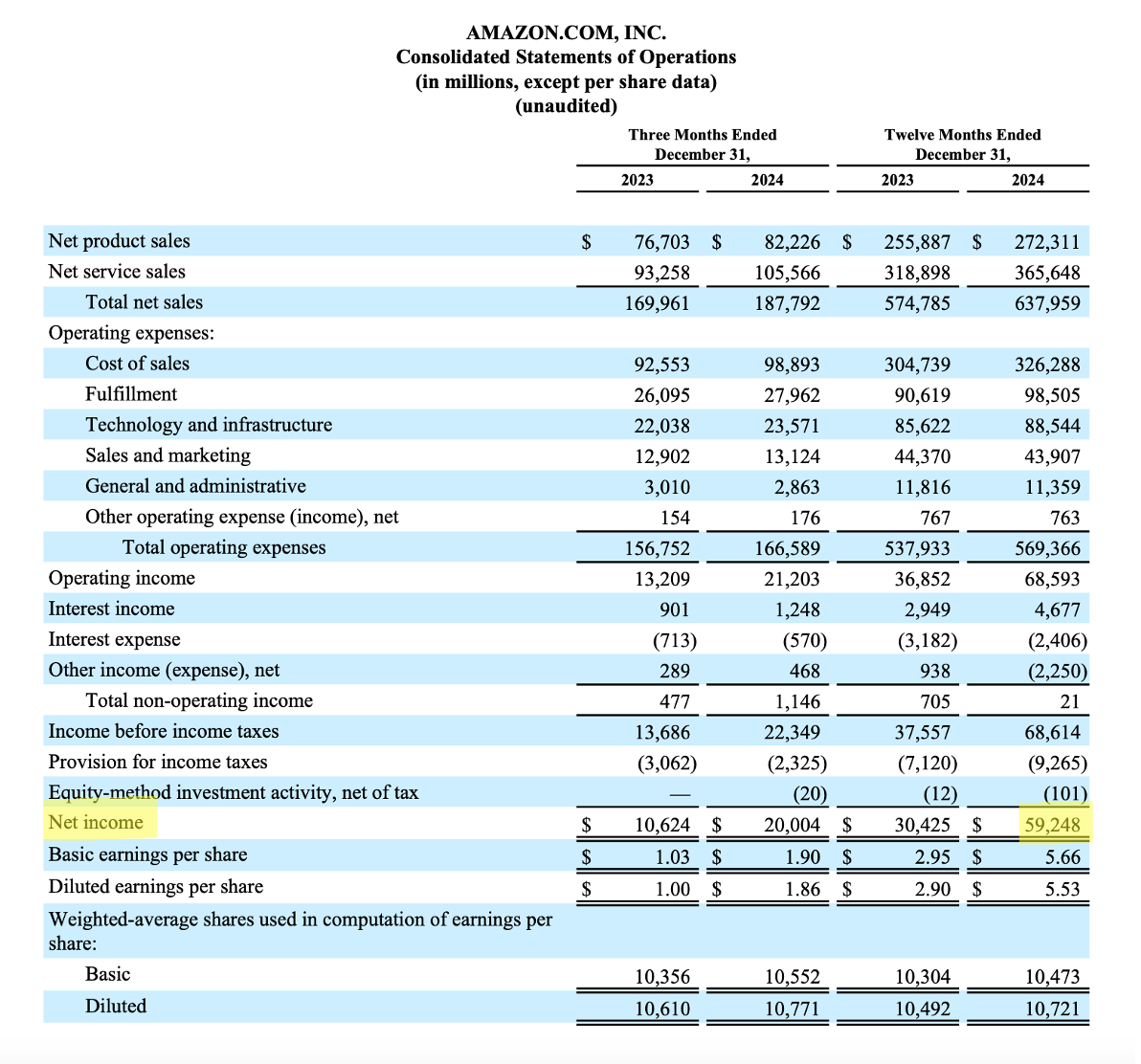

Net Income:

- Found on the Income Statement (also called Profit & Loss Statement)

- It's typically the bottom line, labeled as "Net Income" or "Net Earnings"

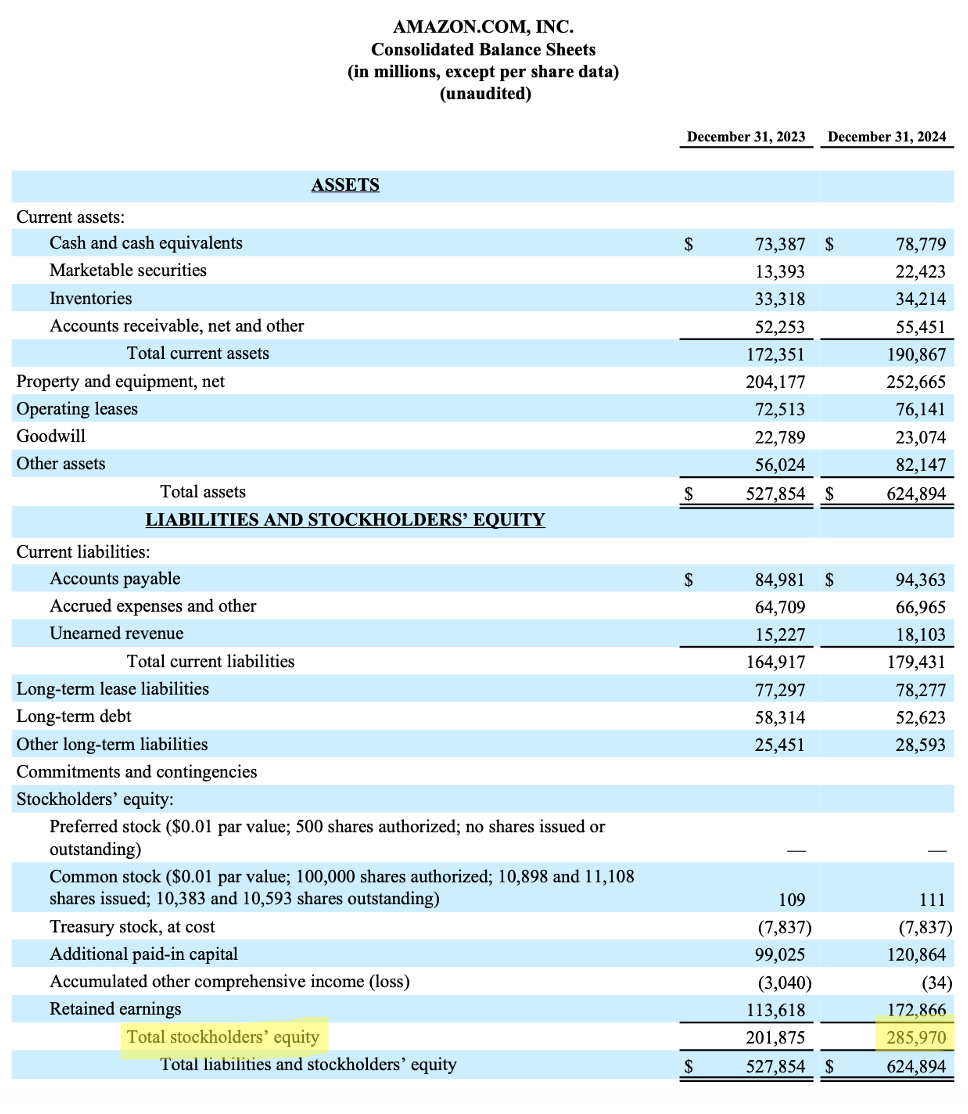

Beginning Shareholders' Equity:

- Found on the Balance Sheet

- For 2025's beginning equity, you'll use the December 31, 2024 balance sheet number

- Look for "Total Stockholders' Equity" or "Total Shareholders' Equity"

In the above Amazon Example Return on Beginning Equity Capital = 59,248 Million % 285,970 Million = 20.17% . In simple terms it means that for every $100 of shareholders' equity at the start of the period, Amazon generated $20.17 in net income.

2. The "Investor's Misery Index": Inflation and Taxes' Devastating Impact

Perhaps the most prescient section of the 1980 letter tackles the insidious effects of inflation and taxes on investment returns. Buffett coins the term "investor's misery index" to illustrate this concept.

"That combination - the inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business (i.e., ordinary income tax on dividends and capital gains tax on retained earnings) - can be thought of as an “investor’s misery index”. When this index exceeds the rate of return earned on equity by the business, the investor’s purchasing power (real capital) shrinks even though he consumes nothing at all."

Explanation: Buffett argues that even a business earning a substantial return on equity can fail to deliver real gains to shareholders if inflation and taxes erode those returns. The "misery index" highlights the importance of considering the after-tax, inflation-adjusted return on investment.

Real-World Application: Imagine a company earning a 20% ROE in an environment with 14% inflation and a combined dividend and capital gains tax rate of 30%. The "misery index" would be 14% + (20% * 30%) = 20%. In this scenario, despite the impressive ROE, the investor's real purchasing power remains stagnant.

Modern Context: With inflation rates fluctuating and tax policies constantly evolving, Buffett's "misery index" remains a critical consideration. Investors need to be aware of the real impact of these factors on their portfolios and seek investments that can outpace inflation and taxes. This often involves focusing on businesses with strong pricing power and tax-efficient investment strategies.

3. The Perils of Long-Term Fixed Income in an Inflationary Environment

Buffett expresses deep skepticism about long-term fixed-income investments in a world where the value of the dollar is constantly eroding.

"We have severe doubts as to whether a very long-term fixed-interest bond, denominated in dollars, remains an appropriate business contract in a world where the value of dollars seems almost certain to shrink by the day."

Explanation: Buffett argues that lending money at a fixed rate for extended periods in an inflationary environment is a risky proposition. The lender effectively locks in a fixed return while the real value of the currency decreases, potentially leading to a loss of purchasing power.

Real-World Application: Consider an investor who purchased a 30-year Treasury bond in 1980 with a fixed interest rate of 12%. While the nominal return seemed attractive at the time, the high inflation rates of the early 1980s significantly eroded the real value of the interest payments, resulting in a disappointing overall return.

Modern Context: While interest rates are lower today than in 1980, the risk of inflation remains a significant concern for bond investors. The principle remains the same: locking in a fixed return for a long period in an environment where inflation could spike is a gamble.

4. The Importance of Strong Management and Ethical Business Practices

Throughout the letter, Buffett repeatedly highlights the critical role of competent and ethical management in driving long-term investment success.

Examples from the Letter:

- Praising Phil Liesche's underwriting discipline at National Indemnity.

- Acknowledging the exceptional performance of Gene Abegg at Illinois National Bank and Trust Company.

- Commending the fairness and honor shown by those who sold their businesses to Berkshire Hathaway.

Explanation: Buffett understands that a company's success is inextricably linked to the quality of its management team. He seeks out leaders who are not only skilled operators but also possess integrity, a long-term perspective, and a commitment to treating shareholders fairly.

Real-World Application: When evaluating a potential investment, investors should carefully examine the track record and reputation of the management team. Look for leaders who have a proven ability to allocate capital effectively, generate consistent profits, and act in the best interests of shareholders.

Modern Context: In an era of corporate scandals and short-term profit maximization, the importance of strong management and ethical business practices cannot be overstated. Investors should prioritize companies with a culture of integrity, transparency, and accountability, as these qualities are essential for sustainable long-term value creation.

Practical Takeaways for Today's Investor

- Focus on ROE: Prioritize companies with consistently high Return on Equity (ROE) rather than relying solely on Earnings Per Share (EPS).

- Factor in Inflation and Taxes: Understand the impact of inflation and taxes on your investment returns and seek investments that can outpace these factors.

- Be Cautious with Long-Term Fixed Income: Carefully consider the risks of long-term fixed-income investments in an inflationary environment and explore alternative strategies.

- Invest in Quality Management: Seek out companies with strong, ethical management teams that prioritize long-term value creation.