Buffett's 1978 Playbook: Timeless Investment Wisdom for Today's Market Chaos

In 1978, Warren Buffett delivered a shareholder letter brimming with wisdom that continues to resonate profoundly today.

Let's unpack some of the key investment lessons nestled within this insightful document and explore their contemporary applications.

The Illusion of Accounting Aggregation: Seeing Through the Noise

Buffett starts by addressing the accounting complexities arising from the merger with Diversified Retailing Company, Inc. He expresses concern that consolidating diverse businesses can "obscure economic reality more than illuminate it." He states:

"Such a grouping of Balance Sheet and Earnings items - some wholly owned, some partly owned - tends to obscure economic reality more than illuminate it. In fact, it represents a form of presentation that we never prepare for internal use during the year and which is of no value to us in any management activities."

Explanation: Buffett highlights the danger of relying solely on aggregated financial statements. These figures, while necessary for reporting, can mask the underlying performance and characteristics of individual businesses within a conglomerate.

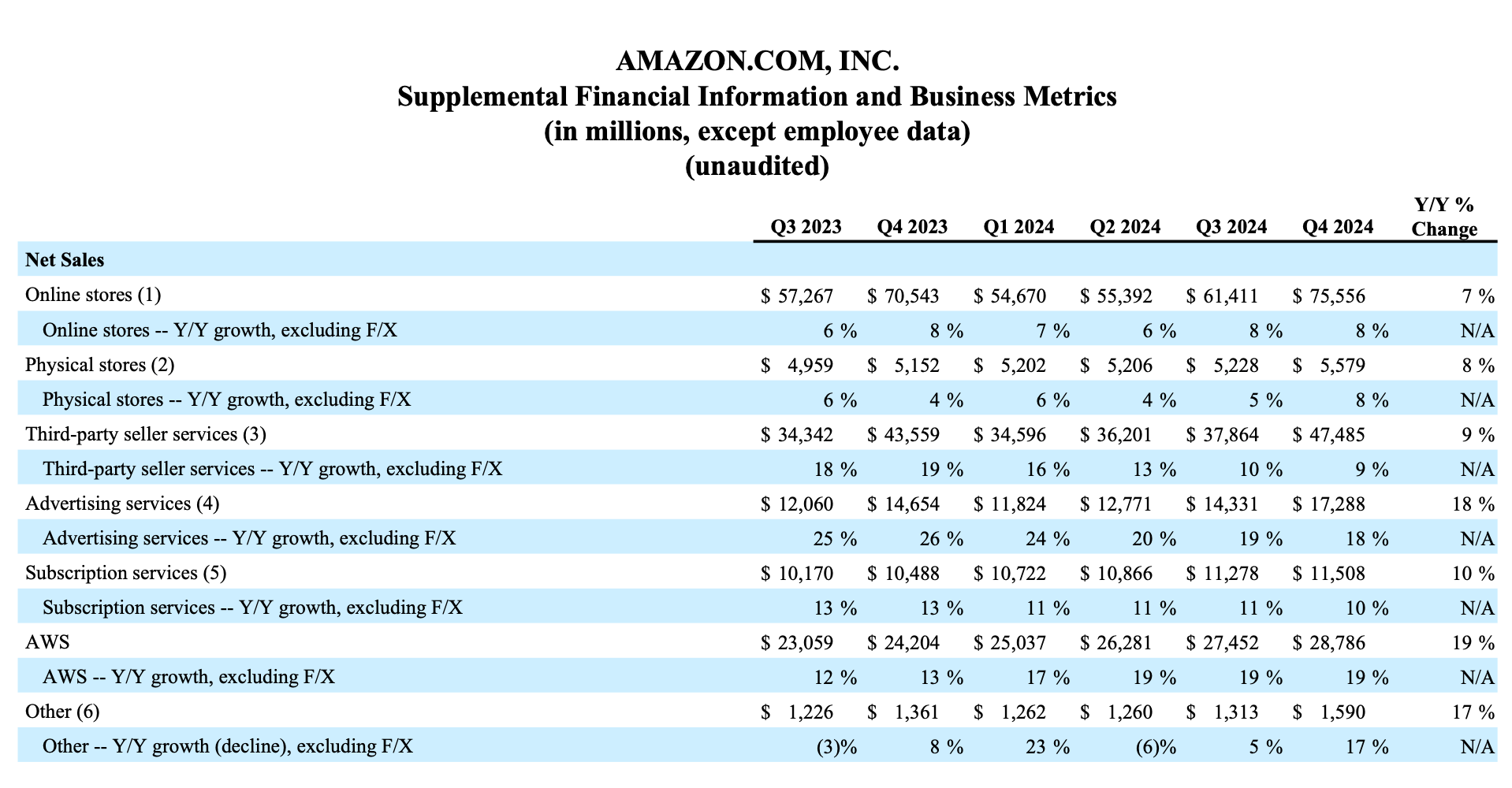

Real-World Application: This lesson is incredibly relevant today, especially when analyzing large, diversified companies. For example, evaluating a giant like Amazon requires understanding the performance of its individual segments – sales from Online, physical stores, AWS, Advertising services etc . – rather than simply focusing on the overall revenue and profit figures. Investors need to "look under the hood" and analyze each segment separately to understand the true drivers of value.

Modern Context and Relevance: With the rise of complex business models and increasingly diversified companies, the need to dissect financial statements is more crucial than ever. Relying solely on headline numbers can lead to misinformed investment decisions. This lesson urges investors to become forensic accountants of their own portfolios.

Note: This information of performance of its individual segments – sales from Online, physical stores, AWS, Advertising services etc can be found in companies earnings reports. Below is an example from Amazon.

Margin of Safety: The Cornerstone of Value Investing

While not explicitly termed "margin of safety" in this particular letter, the concept permeates Buffett's discussion of insurance investments. He emphasizes the importance of buying businesses "at bargain prices, for which little enthusiasm exists." He later elaborates:

"We get excited enough to commit a big percentage of insurance company net worth to equities only when we find (1) businesses we can understand, (2) with favorable long-term prospects, (3) operated by honest and competent people, and (4) priced very attractively."

Explanation: This statement encapsulates the essence of a margin of safety. By purchasing businesses at prices significantly below their intrinsic value, investors create a buffer against errors in their analysis and unexpected adverse events.

Real-World Application: Imagine an investor identifying a fundamentally sound company in the renewable energy sector but noticing that its stock price has temporarily plummeted due to short-term market anxieties related to interest rates. If the investor believes the company's long-term prospects remain robust and calculates its intrinsic value to be far higher than the current market price, a "margin of safety" exists, making it an attractive investment opportunity.

Modern Context and Relevance: In today's volatile market, where meme stocks and speculative bubbles can inflate prices to unsustainable levels, the concept of a margin of safety remains an anchor of rational investing. It's a reminder to avoid chasing hype and instead focus on identifying undervalued assets with strong fundamentals.

The Power of Patience: Waiting for the Right Pitch

Buffett underscores the importance of patience and discipline in investing, stating:

"We are not concerned with whether the market quickly revalues upward securities that we believe are selling at bargain prices. In fact, we prefer just the opposite since, in most years, we expect to have funds available to be a net buyer of securities."

Explanation: Buffett demonstrates his preference for market inefficiencies that allow him to accumulate undervalued assets over time. He's not concerned with short-term gains but rather with the long-term value creation that results from patient accumulation of quality businesses at attractive prices.

Real-World Application: Consider an investor interested in the semiconductor industry. They identify a company with a strong technological advantage and solid management but find its stock price overvalued. Instead of chasing the stock, the investor patiently waits for a market correction or company-specific setback to bring the price down to a more attractive level, demonstrating long-term patience.

Modern Context and Relevance: In an era of instant gratification and fast-paced trading, Buffett's emphasis on patience is a valuable counterpoint. It reminds investors that building wealth requires discipline, a long-term perspective, and the ability to resist the temptation to chase fleeting trends.

The Value of Retained Earnings: Long-Term Growth Catalyst

Buffett highlights the importance of retained earnings in driving long-term value creation, particularly in companies with high capital requirements and strong management teams.

"We are not at all unhappy when our wholly-owned businesses retain all of their earnings if they can utilize internally those funds at attractive rates. Why should we feel differently about retention of earnings by companies in which we hold small equity interests, but where the record indicates even better prospects for profitable employment of capital?"

Explanation: This quote emphasizes the importance of reinvesting profits back into the business to fuel future growth. Buffett recognizes that retained earnings, when deployed effectively, can generate returns that compound over time, significantly enhancing shareholder value.

Real-World Application: An investor analyzing a software company observes that it consistently reinvests a significant portion of its profits into research and development (R&D) to create new products and improve existing ones. If the company's track record demonstrates a strong ability to generate high returns on invested capital (ROIC) from these R&D investments, the investor would view this retention of earnings as a positive sign, indicating future growth potential.

Modern Context and Relevance: In today's knowledge-based economy, where innovation is paramount, the ability to reinvest profits effectively is crucial for long-term success. Investors should prioritize companies with strong management teams that can allocate capital wisely to drive sustainable growth and shareholder value.

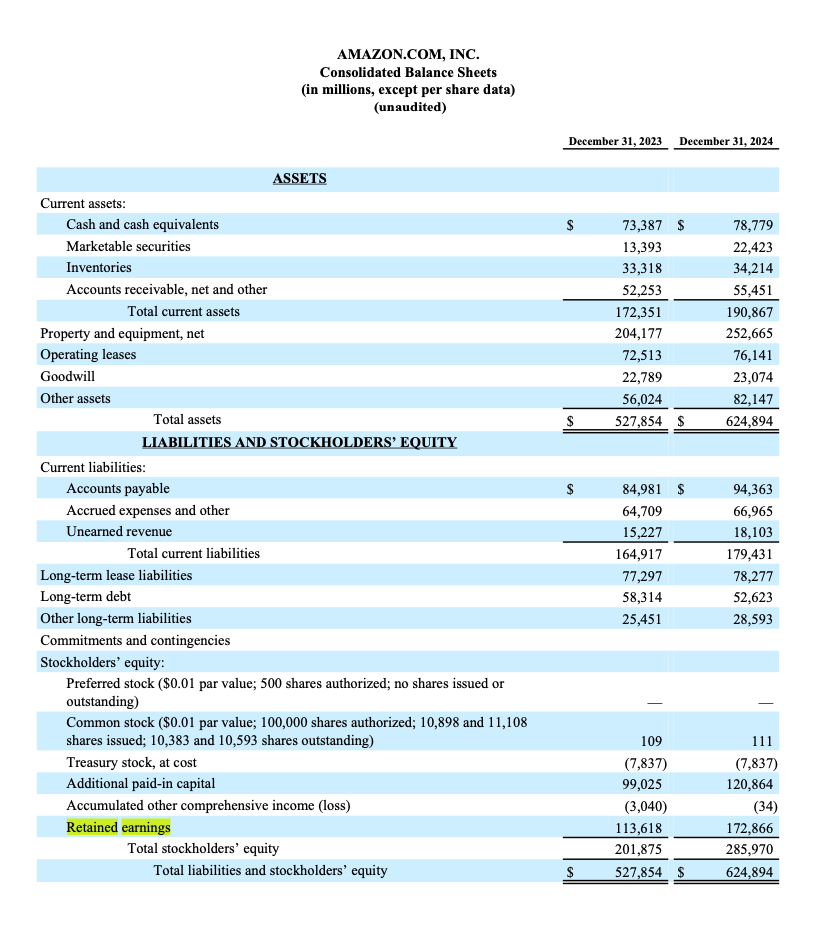

Retained earnings can be found in balance sheet document of a company's earnings release and as you can see in highlighted yellow it represents all the profits Amazon has chosen to keep and reinvest in the business rather than distribute to shareholders as dividends. Amazon retained earnings of $172,866 million (or roughly $172.9 billion) as of December 31, 2024, up significantly from $113,618 million in the previous year.

Benefits of High Retained Earnings:

- Growth Investment Capability Having significant retained earnings gives Amazon tremendous financial flexibility to invest in new ventures, technologies, and market expansion without relying heavily on external financing. This self-funding capability has enabled Amazon to rapidly enter new markets and develop innovative services like AWS, Prime, and their logistics network.

- Financial Stability The large retained earnings balance serves as a financial cushion, helping Amazon weather economic downturns or unexpected challenges. This stability was particularly valuable during periods of market uncertainty.

- Strategic Independence By maintaining high retained earnings, Amazon can make long-term strategic decisions without being overly concerned about short-term market reactions or the need to satisfy immediate shareholder dividend expectations.

- Competitive Advantage The ability to reinvest substantial profits has allowed Amazon to build competitive moats through infrastructure development, technology advancement, and market presence that smaller competitors find difficult to match.

Practical Takeaways for Investors

Based on the insights gleaned from Buffett's 1978 letter, here are some practical takeaways for modern investors:

- Don't Trust Aggregates Blindly: Go beyond headline numbers and analyze the underlying segments of diversified businesses.

- Embrace the Margin of Safety: Prioritize undervalued assets with strong fundamentals and avoid chasing overhyped stocks.

- Cultivate Patience: Resist the urge to trade frequently and wait for attractive opportunities to arise.

- Value Retained Earnings: Recognize the importance of reinvesting profits back into the business for long-term growth.

- Focus on Quality Management: Invest in companies run by honest, competent, and owner-oriented managers.

Connecting Past Wisdom to Present Opportunities

Warren Buffett's 1978 letter serves as a timeless reminder that the fundamental principles of value investing remain relevant, regardless of market conditions or technological advancements. By adopting a long-term perspective, prioritizing rational decision-making, and focusing on quality businesses at attractive prices, investors can navigate the complexities of the modern market and build lasting wealth. The core idea is that even as markets change, human nature and basic business principles remain largely consistent. Thus, wisdom from the past offers a reliable guide for present investment decisions.