Buffett's 1982 Letter: "Why His Lessons on Economic Earnings and Acquisition Follies Matter More Than Ever"

In the annals of investment literature, Warren Buffett's annual shareholder letters stand as beacons of clarity and insight. Among them, the 1982 letter offers a particularly compelling glimpse into Buffett's investment philosophy, during a period of economic uncertainty. Decades later, the lessons within remain remarkably relevant, offering a valuable compass for navigating the complexities of today's market. Let's delve into some of the key takeaways from this letter, exploring their practical applications and enduring significance.

Understanding Economic vs. Accounting Earnings

One of the most enduring concepts Buffett introduces is the distinction between "accounting" and "economic" earnings. He writes:

"We prefer a concept of “economic” earnings that includes all undistributed earnings, regardless of ownership percentage. In our view, the value to all owners of the retained earnings of a business enterprise is determined by the effectiveness with which those earnings are used - and not by the size of one’s ownership percentage."

Explanation: Buffett argues that traditional accounting metrics can be misleading. They often focus on reported earnings and dividends, potentially ignoring the true value creation happening within a company through retained earnings that are being effectively reinvested.

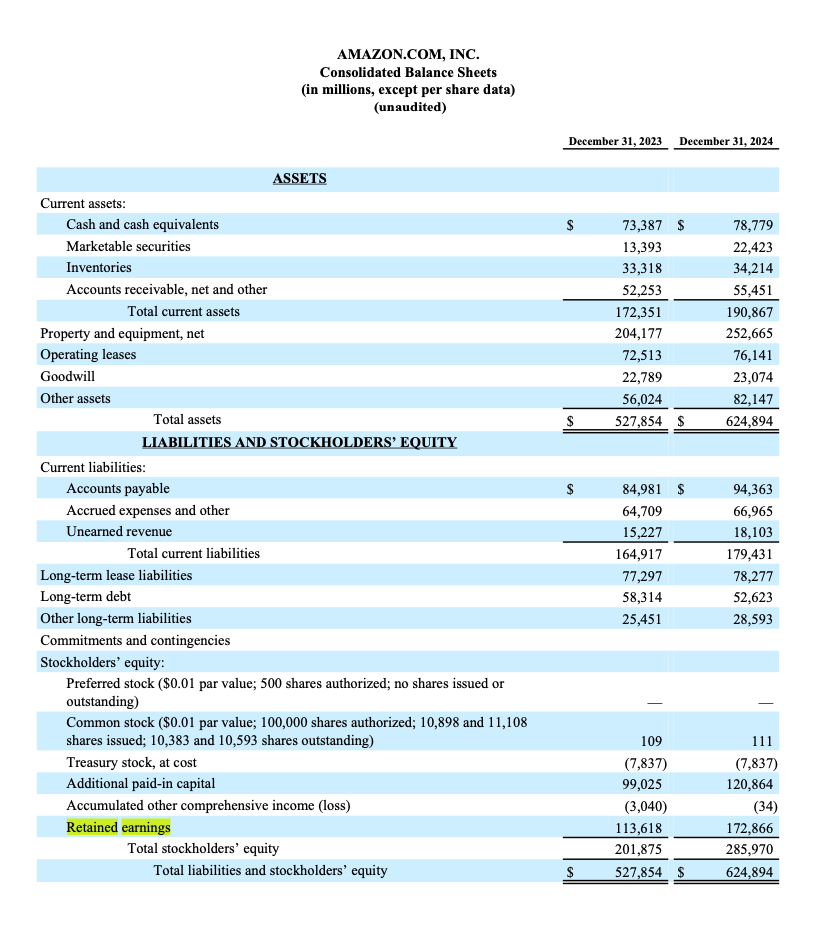

Retained earnings can be found in balance sheet document of a company's earnings release and as you can see in highlighted yellow it represents all the profits Amazon has chosen to keep and reinvest in the business rather than distribute to shareholders as dividends. Amazon retained earnings of $172,866 million (or roughly $172.9 billion) as of December 31, 2024, up significantly from $113,618 million in the previous year.

Benefits of High Retained Earnings:

- Growth Investment Capability Having significant retained earnings gives Amazon tremendous financial flexibility to invest in new ventures, technologies, and market expansion without relying heavily on external financing. This self-funding capability has enabled Amazon to rapidly enter new markets and develop innovative services like AWS, Prime, and their logistics network.

- Financial Stability The large retained earnings balance serves as a financial cushion, helping Amazon weather economic downturns or unexpected challenges. This stability was particularly valuable during periods of market uncertainty.

- Strategic Independence By maintaining high retained earnings, Amazon can make long-term strategic decisions without being overly concerned about short-term market reactions or the need to satisfy immediate shareholder dividend expectations.

- Competitive Advantage The ability to reinvest substantial profits has allowed Amazon to build competitive moats through infrastructure development, technology advancement, and market presence that smaller competitors find difficult to match.

The Advantage of Fractional-Interest Purchases

Buffett highlights the benefits of investing in partially-owned businesses, rather than solely focusing on acquiring entire companies:

"However, this very unevenness and irregularity offers advantages to the value-oriented purchaser of fractional portions of businesses. This investor may select from almost the entire array of major American corporations, including many far superior to virtually any of the businesses that could be bought in their entirety in a negotiated deal. And fractional-interest purchases can be made in an auction market where prices are set by participants with behavior patterns that sometimes resemble those of an army of manic-depressive lemmings."

Explanation: This insight is pure Buffett: He recognizes that the stock market, with its volatility and emotional swings, provides opportunities to acquire stakes in exceptional companies at attractive prices. Buying a small piece of a great business is often easier and more rewarding than acquiring a mediocre business outright.

Real-World Application: Imagine wanting to invest in the consumer staples sector. You might find it difficult and expensive to acquire a complete ownership stake in a brand like Coca-Cola or Procter & Gamble. However, you can readily purchase shares in the stock market, benefiting from their strong brands, consistent earnings, and global reach, without the headaches and risks of total ownership.

The Perils of Managerial Adrenaline

Buffett cautions against the allure of "Acquisition Follies," where the thrill of the chase overshadows sound judgment:

"As we look at the major acquisitions that others made during 1982, our reaction is not envy, but relief that we were non-participants. For in many of these acquisitions, managerial intellect wilted in competition with managerial adrenaline The thrill of the chase blinded the pursuers to the consequences of the catch."

Explanation: Buffett emphasizes the importance of discipline and avoiding impulsive decisions driven by ego or the pressure to grow. He warns that overpaying for acquisitions, especially when using overvalued stock, ultimately destroys shareholder value.

Real-World Application: Consider the cautionary tales of companies like AOL Time Warner merger in 2000. The desire for rapid expansion and market dominance drove management to overpay for an acquisition that ultimately proved disastrous, leading to massive write-downs and shareholder losses.

Modern Relevance: This lesson is particularly relevant in today's environment of readily available capital and intense competition. Companies often feel pressured to make acquisitions to stay ahead, but Buffett's warning serves as a reminder to prioritize value creation over empire-building.

The Importance of Issuing Shares Intelligently

Buffett dedicates a significant portion of the letter to the dangers of issuing shares when a company's stock is undervalued:

"Our share issuances follow a simple basic rule: we will not issue shares unless we receive as much intrinsic business value as we give. Such a policy might seem axiomatic. Why, you might ask, would anyone issue dollar bills in exchange for fifty-cent pieces? Unfortunately, many corporate managers have been willing to do just that."

Explanation: Buffett argues that issuing undervalued stock to fund acquisitions or other initiatives is akin to giving away wealth. He criticizes managers who prioritize growth over shareholder value, emphasizing that dilution of existing owners' equity should be avoided unless the acquired assets contribute equal or greater value.

Real-World Application: A startup using overvalued stock during a market boom to acquire smaller competitors might seem like a clever move initially, but the long-term impact can be detrimental if the acquired businesses don't justify the dilution of existing shareholders' equity.

Modern Relevance: This lesson is critical for investors in growth stocks, where valuations can be highly speculative. It's essential to assess whether a company's growth strategy is creating genuine value or simply diluting shareholders through excessive stock issuance.

Practical Takeaways for Investors

Based on the insights from Buffett's 1982 letter, here are some practical takeaways for modern investors:

- Focus on Economic Reality: Look beyond reported earnings and understand how a company is truly creating value through retained earnings and reinvestment.

- Embrace Fractional Ownership: Don't be afraid to invest in partially-owned businesses through the stock market, gaining exposure to a diverse portfolio of great companies.

- Avoid the Acquisition Follies: Be wary of companies that are overly acquisitive, especially when they use overvalued stock to fund deals.

- Value Dilution Matters: Pay close attention to a company's stock issuance policies and avoid companies that dilute shareholders' equity without a clear path to value creation.

- Long-Term Thinking: Investment should be a long-term game. Volatility should be expected and not cause panic that forces the sale of sound investment decisions.